Condo Insurance in and around Durant

Get your Durant condo insured right here!

State Farm can help you with condo insurance

Welcome Home, Condo Owners

There is much to consider, like providers savings options, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a difficult decision. Not only is the coverage remarkable, but it is also well priced. And that's not all! The coverage can help provide protection for your condo unit and also your personal property inside, including things like electronics, cookware and mementos.

Get your Durant condo insured right here!

State Farm can help you with condo insurance

Condo Coverage Options To Fit Your Needs

It's no secret that life is full of surprises, which is all the more reason to be prepared for the unexpected with condo unitowners insurance. This can include instances of liability or covered damage to your unit from an ice storm, a tornado or theft.

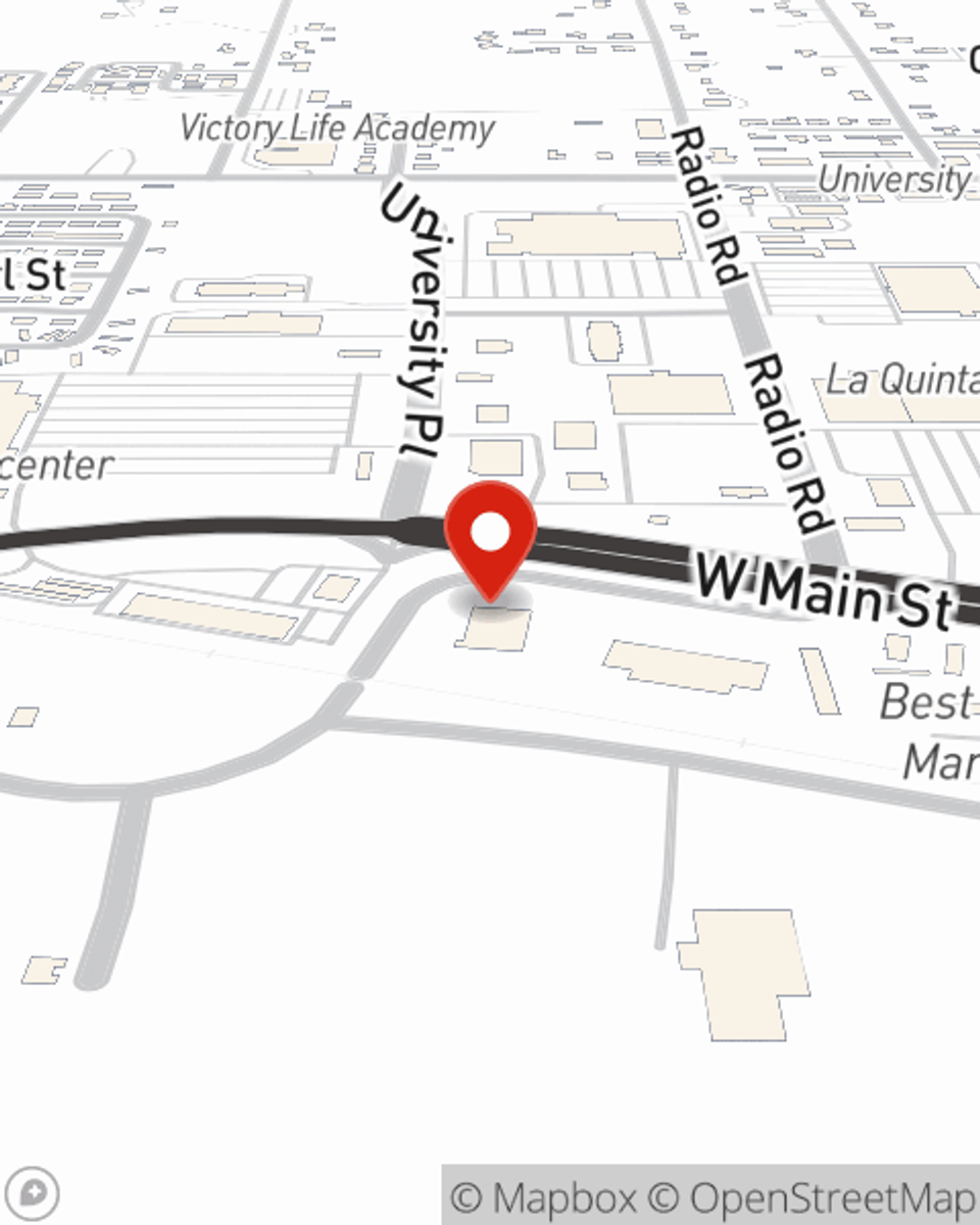

Intrigued? Agent Jim McGill can help clarify your options so you can choose the right level of coverage. Simply call or email today to get started!

Have More Questions About Condo Unitowners Insurance?

Call Jim at (580) 924-8686 or visit our FAQ page.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.

Simple Insights®

How to throw a safe house party

How to throw a safe house party

Learn tips about hosting a safe party at home, respecting your neighbors when you have parties and minding noise pollution laws.

How to get rid of fruit flies in 5 easy steps

How to get rid of fruit flies in 5 easy steps

Fruit flies can infest your drains, trash cans and house plants. These steps can help keep fruit flies away from your home.